Go4hosting Blogs

Featured Blogs

Data Embassy-Powering India’s Tomorrow

Maximizing Profits with VPS Hosting in Forex Trading

Secure Your Cloud Server With Zero Trust Policy

3 Reasons You Should Engage in a Cloud Server

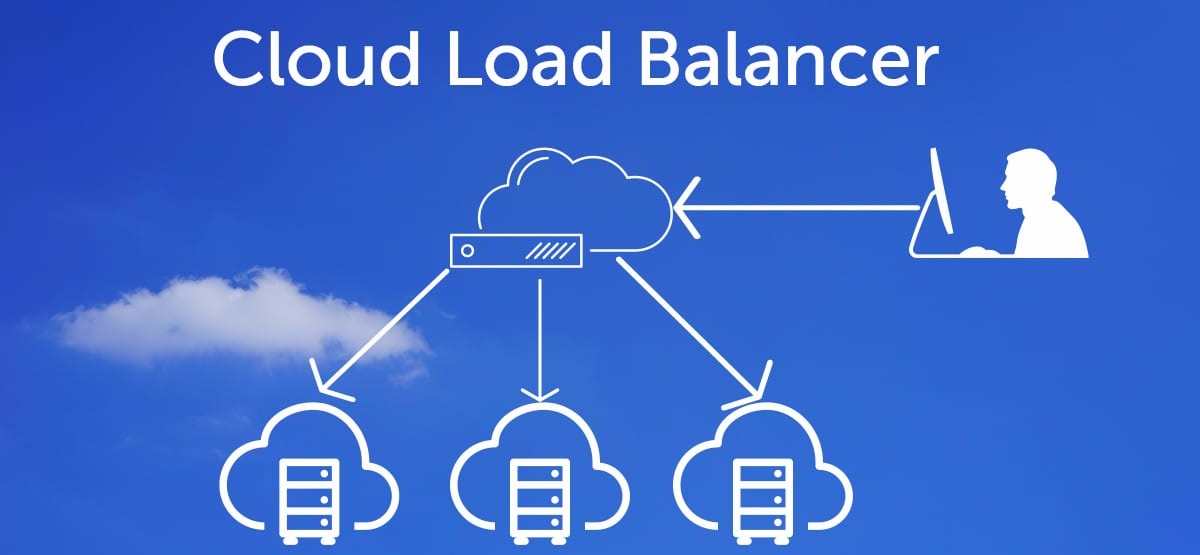

Cloud Load Balancing - What You Need to Know?

How do fast Dedicated Servers help your business?

Which are the 10 Best Linux Distributions for VPS?

A to Z about Java Application Hosting and its Models

Go4hosting Blogs

Category

Alibaba Cloud

Application Hosting

AWS Cloud

Big Data

C Panel Hosting

Cloud CDN

Cloud computing

Cloud Hosting

Cloud storage

CMS Hosting

Colocation Hosting

Data Backup

Data Centers

Data Storage

Dedicated Hosting

Dedicated Server

Disaster Recovery

Domain Hosting

Ecommerce Hosting

Edge Computing

Email Hosting

File hosting

GPU Server

Hybrid Cloud

Internet

Joomla Hosting

Magento Hosting

Managed Dedicated Hosting

Managed Hosting

Microsoft Azure

server hosting

Server Management

Shared Hosting

SSD Server

SSL

Technology

Virtual Machine

VM Hosting

VPS Hosting

Web Hosting

Web Hosting Services

Website

Windows Cloud Server

WordPress Development

WordPress Hosting

wordpress website